Intel: Revival on the Horizon? An In-Depth Analysis and Investment Opportunities for 2024

Intel has experienced a significant decline, losing over 50% from its 2021 highs. This article will delve deeply into the reasons for this devaluation, analyze the company's future prospects, and provide a technical commentary based on Gann's "Square of 144" charts. Let's explore why Intel could represent an interesting investment opportunity for 2024.

6/10/20242 min read

Reasons for Intel's Devaluation

In recent years, Intel has faced numerous challenges that have negatively impacted its stock performance.

Intense Competition

Fierce competition from Asian companies with lower costs, such as TSMC, has reduced the American company's operating margins.

Increased R&D Spending

Additionally, Intel has had to significantly increase its spending on research and development, leading to the establishment of Intel Foundry in February 2024. This project aims to internalize chip production, reducing operational costs through strategic partnerships and acquisitions. For example, Intel has collaborated with Microsoft and over 300 other partners in the United States to improve efficiency and reduce costs, acquiring companies like Silicon Mobility, which specializes in electric vehicles, and Articulate, active in the artificial intelligence sector.

Growth Prospects

Despite recent difficulties, the growth prospects for Intel are promising.

Earnings Growth

Forecasts indicate an 85% growth in earnings per share (EPS) in 2025 and a 50% growth in 2026, a notable improvement compared to the current growth of 3%. Furthermore, the US government has allocated significant funds to Intel through the Secure and Clay program, further strengthening the company's financial position.

Key Statistics

Approximately $3.5 billion of government funds allocated to Intel through the CHIPS Act of 2022 have been reassigned to the Secure and Clay program, supporting Intel's operations in the national defense sector.

Fundamental Analysis

According to fundamental analysis, the intrinsic value of Intel shares is significantly higher than the current market price. Using methodologies such as discounted cash flow, Peter Lynch's method, and economic value added, the fair value of Intel shares is estimated to be around $49.20 per share. This suggests that the stock is currently undervalued by 50%, representing an interesting investment opportunity for long-term investors.

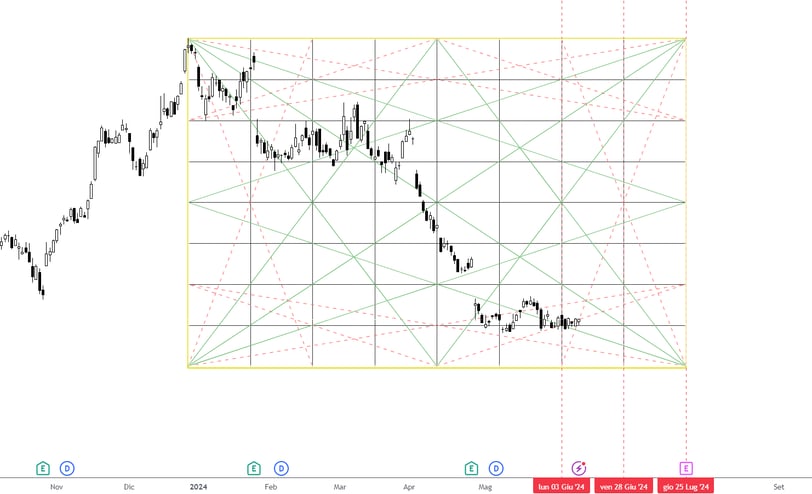

Technical Commentary: Gann's Square of 144

The "Square of 144" chart by Gann applied to Intel's stock shows a series of geometric configurations highlighting key price and time levels. This tool, developed by the famous trader W.D. Gann, is used to identify price/time levels, relative reversal points, and market cycles.

Observing the chart, we notice that Intel's price has reached a critical support zone between $30.50 and $29 per share, where the price is consolidating after a long descent from the historic high. This support area is further reinforced by the convergence of Gann's fans, indicating a potential medium-term trend reversal.

Valuation and Trading Strategies

For traders, the current price level represents a buying opportunity. We recommend placing stop losses below the 2022 low at around $24 per share, with a target price between $42 and $45, representing a potential increase of 40% from the current price.

Conclusion

Intel represents an interesting investment opportunity for those seeking a mid-term investment. Despite recent difficulties, growth prospects and technical evaluations indicate that the stock might be undervalued and ready for a recovery. Follow us to stay updated on future evaluations and strategies.

The reference point for online finance and trading.

© 2024. All rights reserved.

Privacy Policy

Your privacy is important to us. Finance Inside is committed to protecting your personal information. When you subscribe to our newsletter or use our services, we collect personal information such as your name and email address to send you relevant content and updates about our services. This information will not be shared with third parties without your consent, except as required by law. We use advanced security measures to protect your data from unauthorized access.

Terms of Service.

Welcome to Finance Inside. By using our services, you agree to be bound by the following terms and conditions. The content and services provided by Finance Inside are intended for informational and educational purposes only and do not constitute financial advice or personalized investment recommendations. Finance Inside does not guarantee the accuracy, completeness, or reliability of the information provided. Users are responsible for their own financial decisions and any associated risks. Subscriptions to our services can be canceled at any time, with cancellations made at least 24 hours before renewal to avoid charges for the next period.

Disclaimer

The content provided by Finance Inside, including financial reports, eBooks, and other educational resources, is for informational and educational purposes only and does not constitute financial advice or personalized investment recommendations. Finance Inside does not guarantee the accuracy, completeness, or suitability of the information provided for any specific purpose.

The use of the information provided is at the sole discretion and risk of the user. Finance Inside will not be responsible for any losses or damages resulting from the use of the information provided in financial reports, eBooks, or other content.

Users are encouraged to consult a qualified financial advisor before making investment decisions.

Follow us on